**Update-

Grab the 2021 Financial Planner!

Yesterday I shared my latest printable, the Soon to be debt free workbook. Today I am back to go into detail about the specific pages of the binder.

So let’s get started, Paying off debt!!

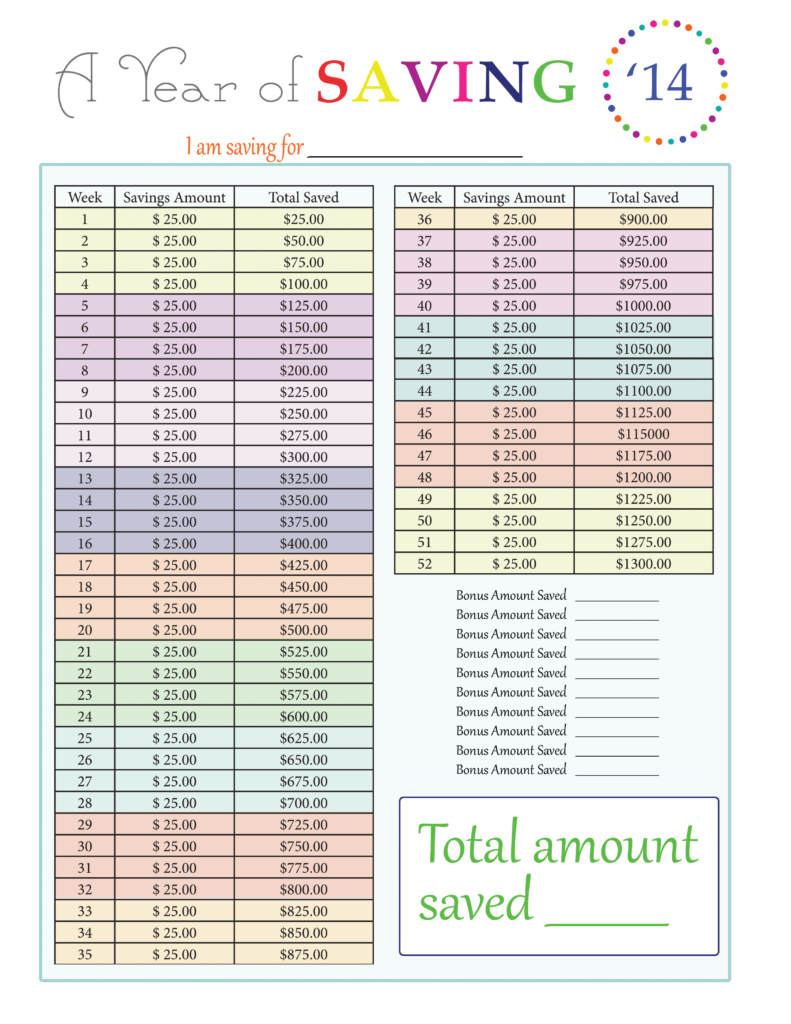

First up we have the Year or saving page. If you are not sure what the heck this is, check this out. Even though we are committing to paying of our debts, I think it is important to find a balance! So I will be sticking to this plan.

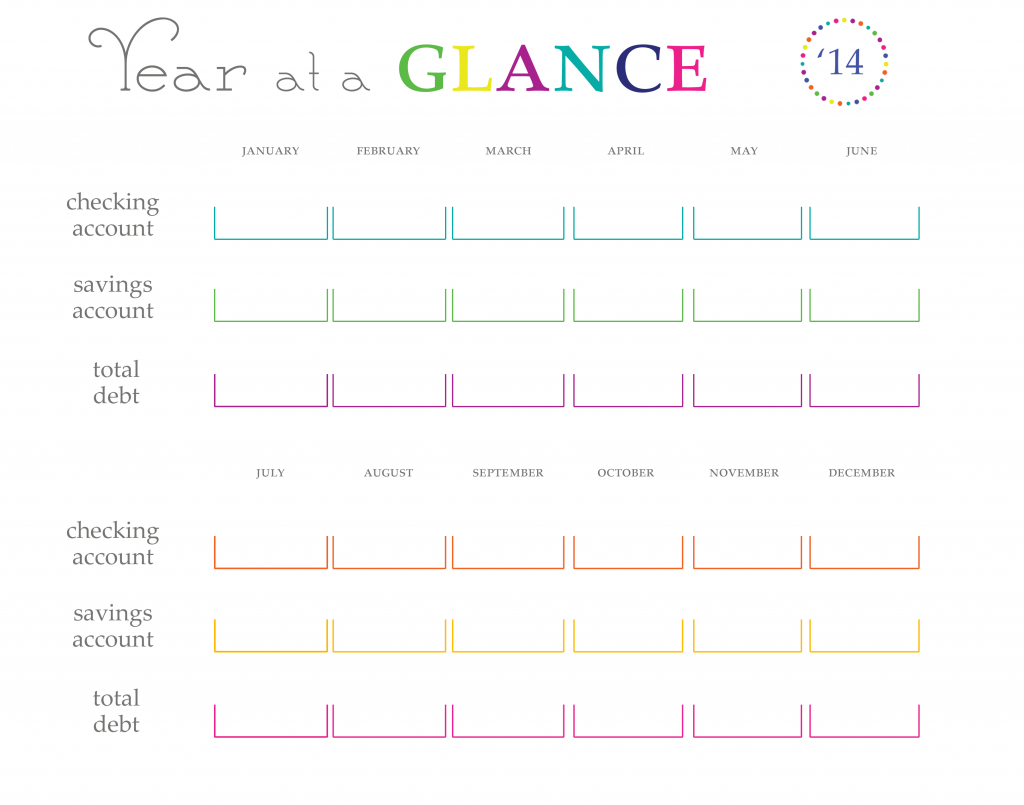

Then we have the Year at a glance page. This is a quick look at your total debt and your cash on hand balances. When paying your bills every month total up your balances, combine them and fill in this chart. The goal is that over the course of the year you will see this number decline. *DO NOT total up your payment, but instead, total up your BALANCE.*

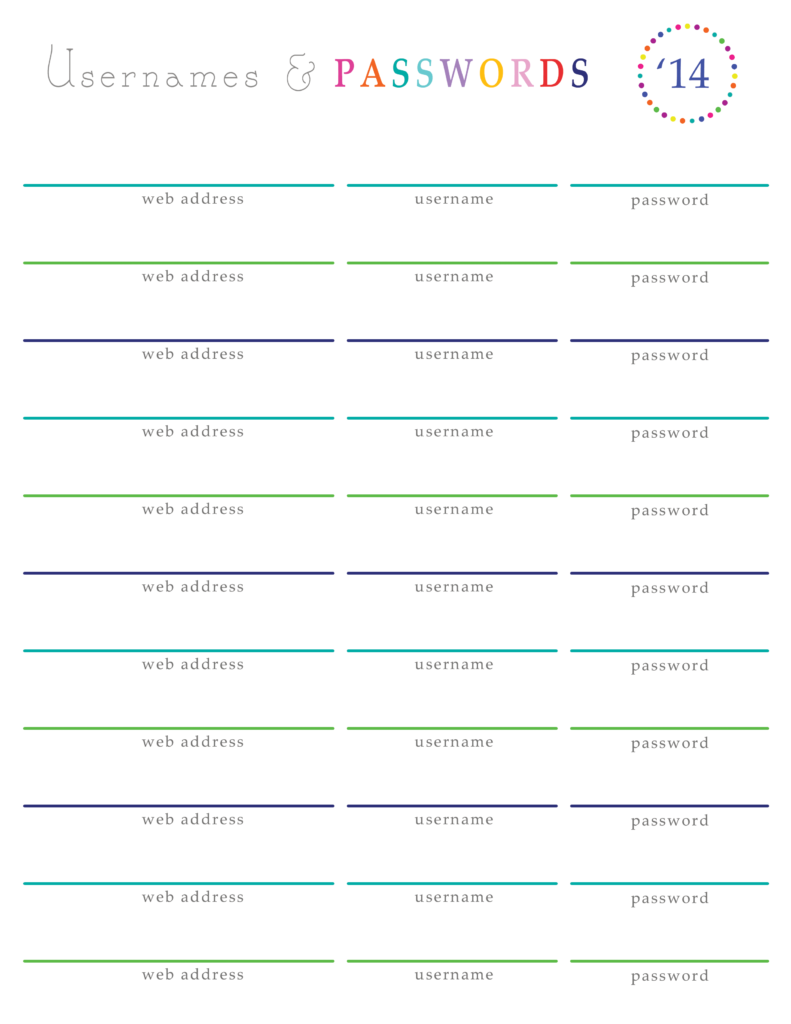

Username and passwords- I have seen a lot of these forms all over the inter-webs. However, when it comes to bill pay, I need it to be simple. For the most part, I know my usernames and passwords but it is nice to have them in one spot for quick checks. This is also very helpful for the accounts you do not use on a regular basis. I use it for our TurboTax account since I only log in once a year I would never remember. It ends up saving me a lot of time and frustrations tracking down those login details. *I recommend using a pencil for your password for any account that requires frequent changes. Like our bank does! Every.Three.Months!

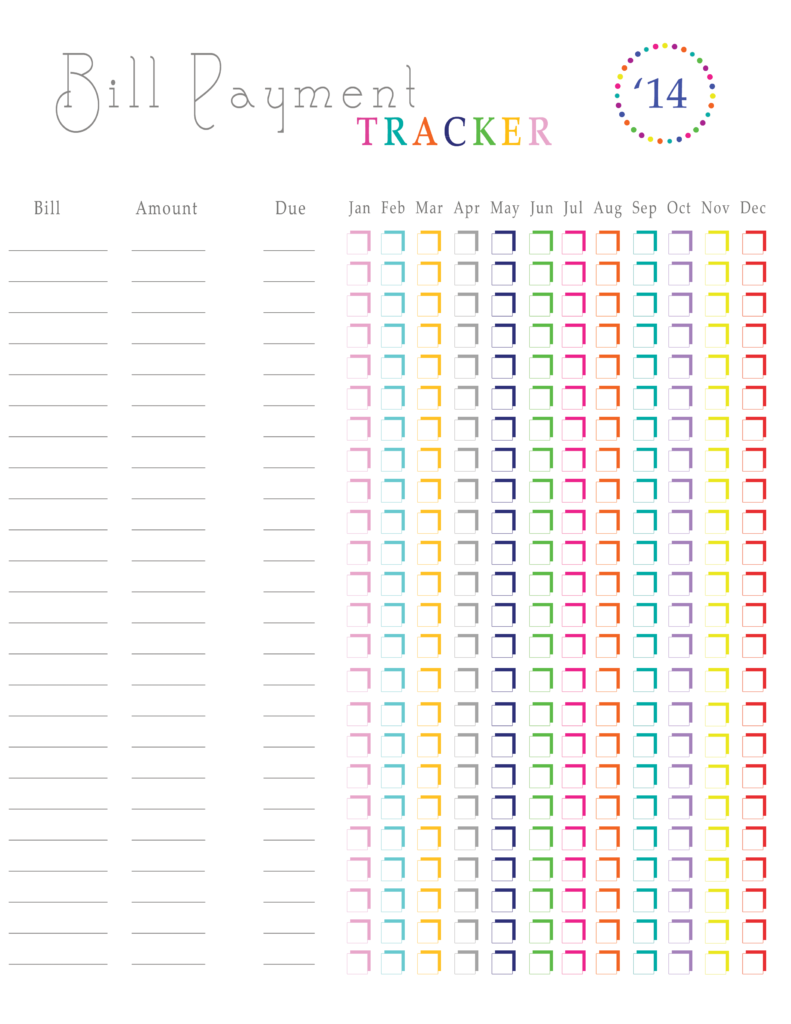

Bill Payment Tracker- This is also important for bill payment. This will help you keep track of what you are paying, what the amount is supposed to be, and the due dates.

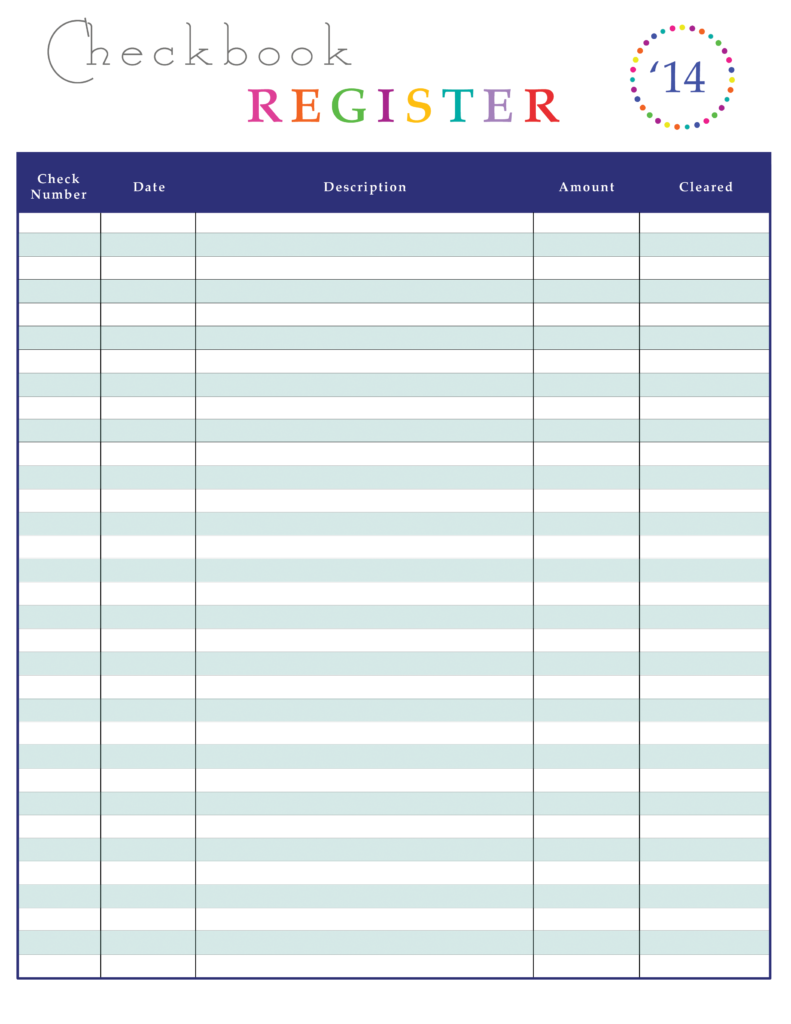

Checkbook Register. It is a rare occasion that I write a check. However, when the time arises it is nice to have this form. I could not for the life of me tell you where to find a checkbook register that comes with my checks. This is a very important form when we get to talking about sitting down and paying your bills. Don’t worry I have a printable for that too! (And it just might be my favorite one of all!).

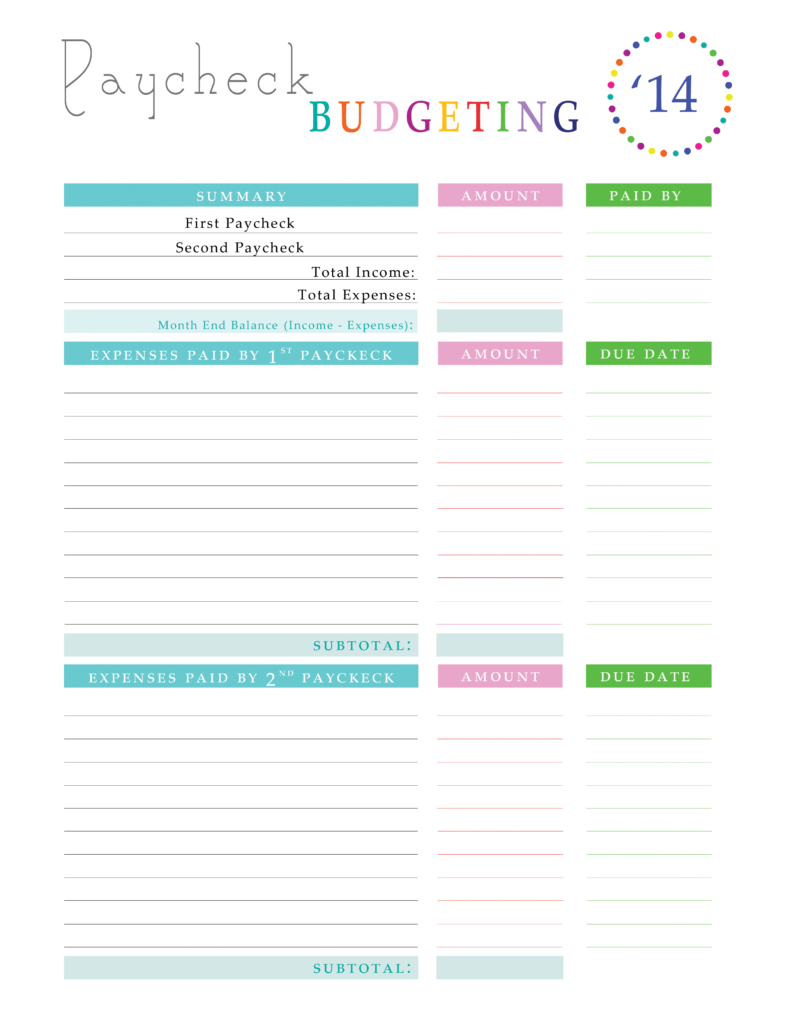

Paycheck Budgeting- This is not for everyone, especially those who get paid weekly, quarterly or if your paycheck varies. But, if you are like us this way of budgeting has been a godsend for our family. I love it. Scott gets paid every two weeks…guaranteeing two paychecks a month. I know that the first paycheck of them month will never come later then the 15th, and the second one will never come later than the 30th. We also know the exact amount of each paycheck. Therefore, this system is pretty easy for us. There are set bills that get paid by the first paycheck, and the remainder with the second paycheck. PLUS twice a month Scott will get an “extra” paycheck (3 in one month) usually in May and November. We consider those paychecks bonuses.

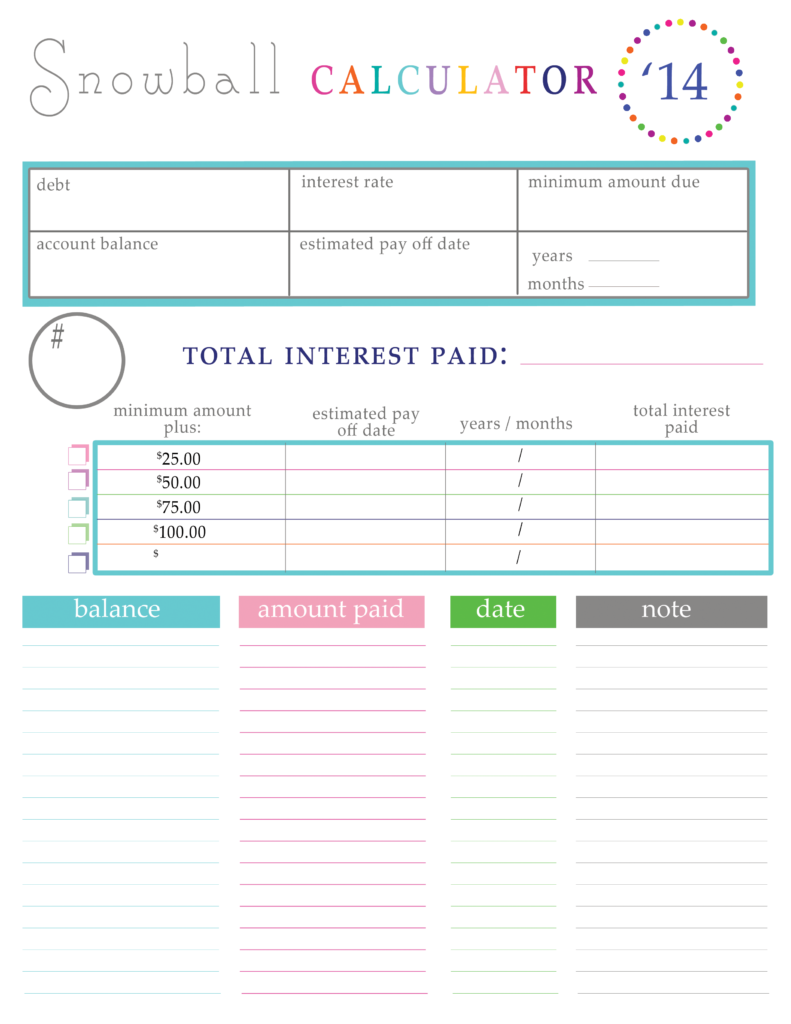

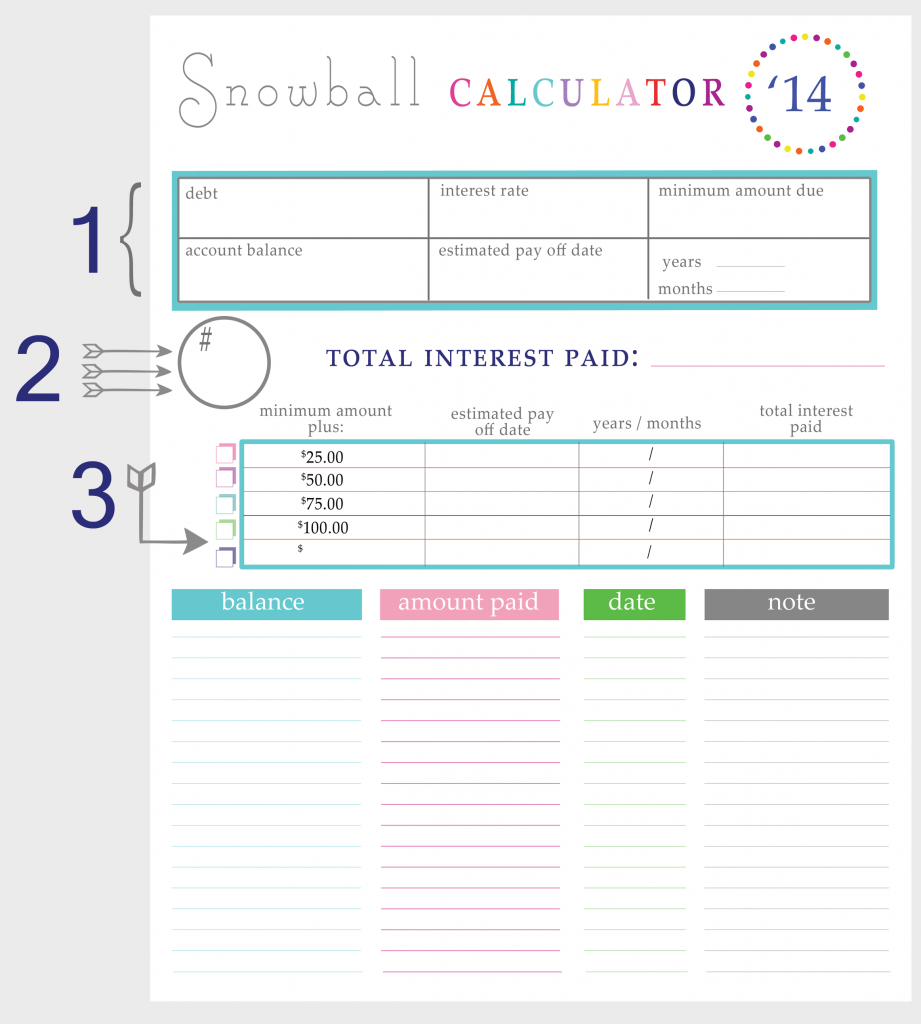

Snowball Calculator- I love this form! This is what we will be using to help us pay down those debts!

Let’s chat about filling this out:

Let’s chat about filling this out:

1) Visit the Full Debt Overview form, and fill in the top section of this page

2) Once you finish with step 3 (and all other debts) come back to this and assign a priority number. Is this debt 1st priority or maybe it is your mortgage and you have some credit cards you want to focus on first, so this is your 5th priority.

3) Go back to the crown.org site. Now adjust your payment amount! Change it by increasing it by $25.00, $50.00, $75.00, then $100.00. Fill in the changes you see in the payoff date, and total interest paid. This will help you see how just a little bit more every month towards the debt can dramatically pay it down! The last amount is left blank for you to fill in with whatever figure you’d like! Maybe you can only afford an extra 15.00 a month a first, or perhaps this is the 4th debt you are paying off so you are able to add the payments from 1-3 and can pay a lot more than $100.00. I have created a google spreadsheet – that can calculate your debt snowball in a beautiful spreadsheet – that allows you the ability to change your numbers!! Grab it here!

Select what payment amount you are going to commit to, then start paying off our debts!!

I will see you all soon, with round 3! 🙂

Next up I will be sharing more about how we budget, and one of my favorite printables off all time. 🙂

Find links to the rest of the series below:

Interested in other paying off debt worksheets/money saving articles? Make sure you check these out!

- The ONE worksheet EVERYONE needs to use when paying bills is THIS!

- Save money at the grocery store with these 7 apps!

- Save money during the holiday season by starting early! Use this free printable to track your gifts!

*A lot of people have asked what I used to assemble my workbook. I used the following:

Guys you should try Dzaine money making system – earns a lot for me, just search it in google

While I love all of this in theory and the pages are all very beautifully done – it all seems like way too much paperwork for 2014. I highly recommend using mint.com to consolidate and see everything – I have auto-pay for all major payments or linked to CC to pay (and earn me points) and I just have to look monthly at what I’m spending after all those fixed costs (we always pay off all debt besides school and car loans in full) – we have about 250K in loans also as my husband went to med school and will probably be paying it off forever. I also export mint.com’s transactions into a spreadsheet that I created that then drops things into the correct bucket so I can see our family’s profit and loss statement at any given time and where we are spending too much and reign it in for the next month.

I’ve used mint.com and I have a hard time going back and adjusting things that have been miscategorized and as I purchase many things online through my amazon prime account it doesn’t usually know what category to use. I do love the concept and before I had children and pets (read: when I didn’t buy in bulk and had time to go to the store to shop) it was great. Now I really need the combination of online banking and paper tracking to keep my husband and I on the same track.

Not to be “that person”, but I’d recommend AGAINST mint.com. As a software developer, I’m afraid I’ve become a bit of a security freak by nature and upon looking into it further, it looks like mint uses screen scraping scripts to gather the information from your third party accounts (such as your bank, insurance, credit card company, etc). In order to do this, that means they are storing your credentials somewhere, meaning all your credentials are stored in one place and are one successful hack away from exposing all the credentials you’ve ever given to them.

On the other hand, mint.com is easy and as far as I’m aware of, hasn’t had any data breaches yet.

Just my two cents and I hope none are offended. I just like to make sure people know all sides before making a choice.

Great blog, by the way! I’m really enjoying the helpful printables especially!

I agree. Look this certainly isnt for everyone. But there are a small amount of use type a personalities who still (even in 2014) like to see and write things. There is more than one way to skin a cat use what works for you.

It’ s 2020 and I still prefer paper over digital. It’s a tactile thing for me, plus in the hectic world I have things like these force me to slow down and take some time out of the hustle.

Do you have this in Excel format? I’d much rather prefer tracking my bills on the computer.

Sorry, but I do not have this in excel format.

THANK YOU! I found this through pinterest. Your printables are beautiful! Additionally, thank you for including the resources that is crown.org. I’d never been to their site before but now I can’t stop tinkering with their calculator. Planning a snowball always seemed like so much math but with this resource it is easy!

Hi! I love your homeblog it is awesome! Thanks for all the great resources that you have offered. They are great! Do you happen to have the debt free workbook for the new year 2015?

Thanks!

I just posted the 2015 Soon-To-Be Debt Free Workbook!!

xo,

Lindsay

This is an amazing workbook! Not just for me to use (which I am going to), but to use with kids I tutor in math so I can utilize beginning algebra and reinforce the basics, while making math relevant to their life. Thank you!!

Our family is currently using your 2015 workbook and I love it. Will you be releasing a 2016 version? I sure hope so. Thanks for all of the wonderful information.

Sorry. I should have been more specific. We are using your debt free by 2015 workbook. I was wondering if you will be releasing a 2016 version of it. Sorry for any confusion. Thanks

I will be releasing 2016 next week! I am super excited about it, I am loving the overall look, and the new additions!!

xoxo

Lindsay

Hi we really want to get out of debt and then and only then.start to build wealth.

Thank you for your beautiful work. You are helping a lot of people.